Stablecoins and short-term funding markets

Abstract

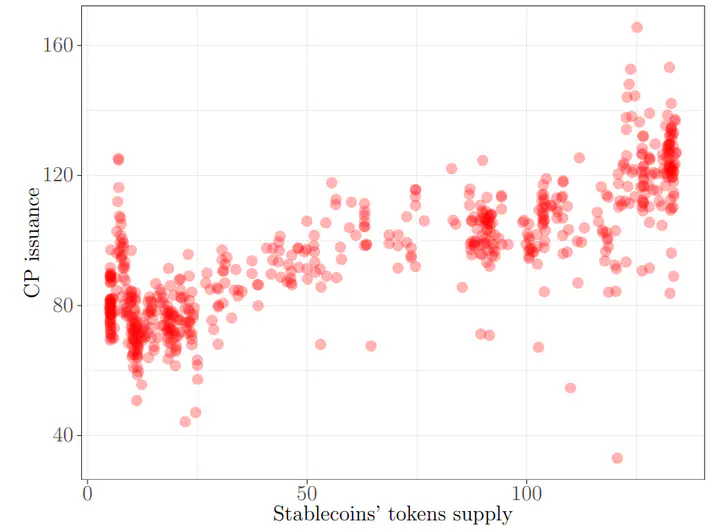

The market capitalization of stablecoins – crypto-assets aiming at maintaining their value stable, and generally pegged to a fiat currency – has skyrocketed over the past year. This paper studies the implications for the real economy and describes a link with the short-term debt markets, key for the funding of banks and firms. The reason is that issuers of stablecoins hold a large amount of commercial papers in US dollar to back the value of their tokens. We show that changes in the stablecoin market capitalization are correlated with the issuance of commercial papers and their interest rates, and run placebo tests to confirm these findings.

Type