Benoit Nguyen

Research Economist, Central banker

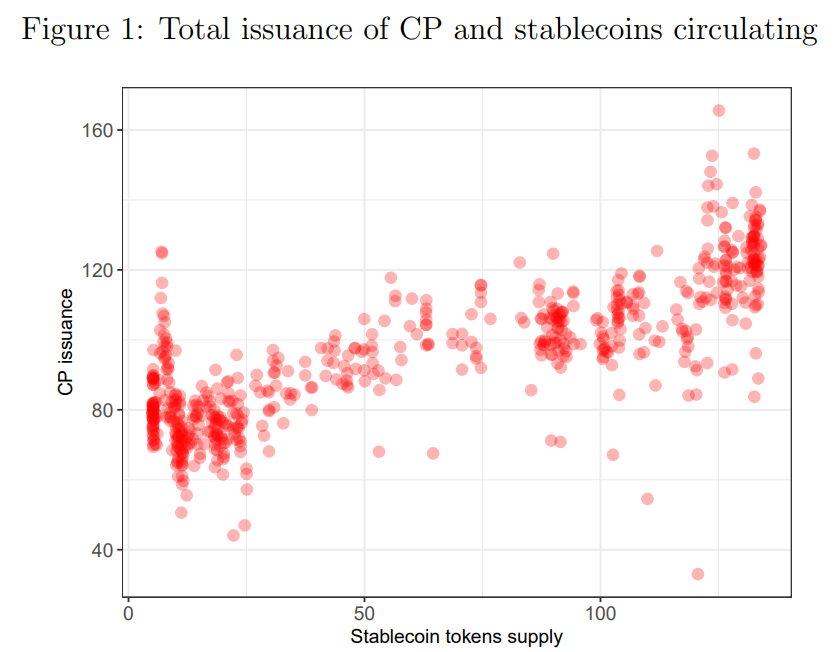

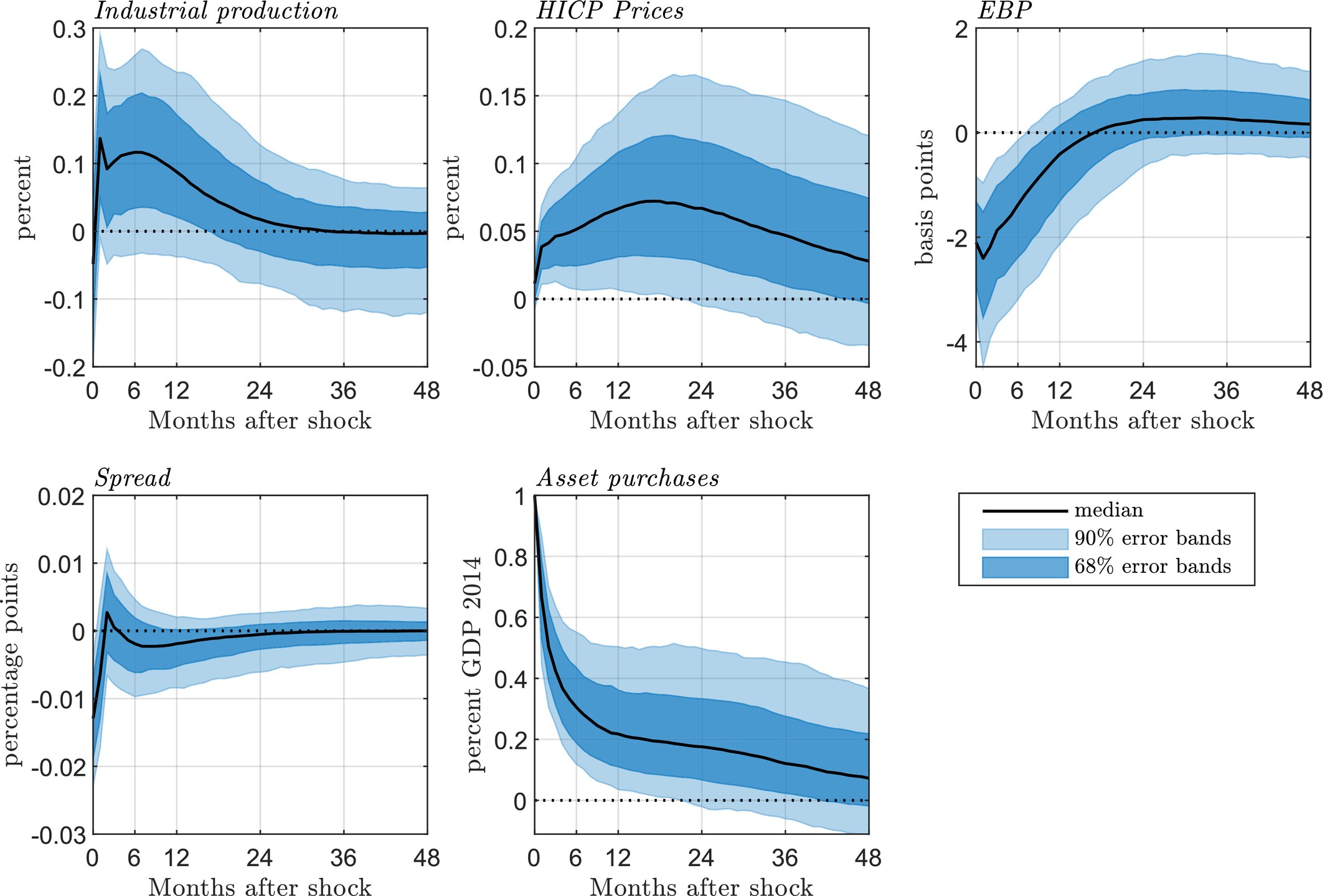

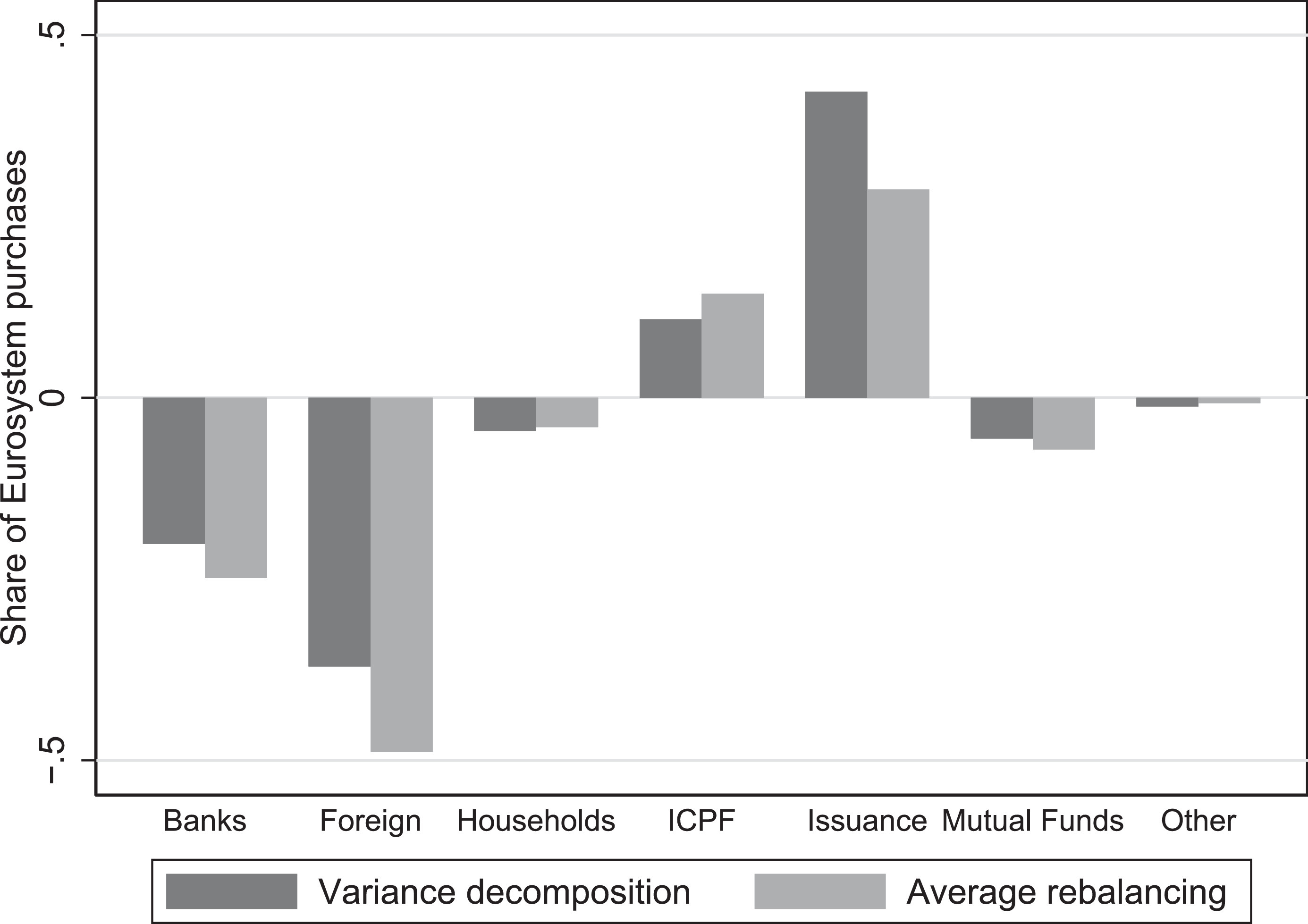

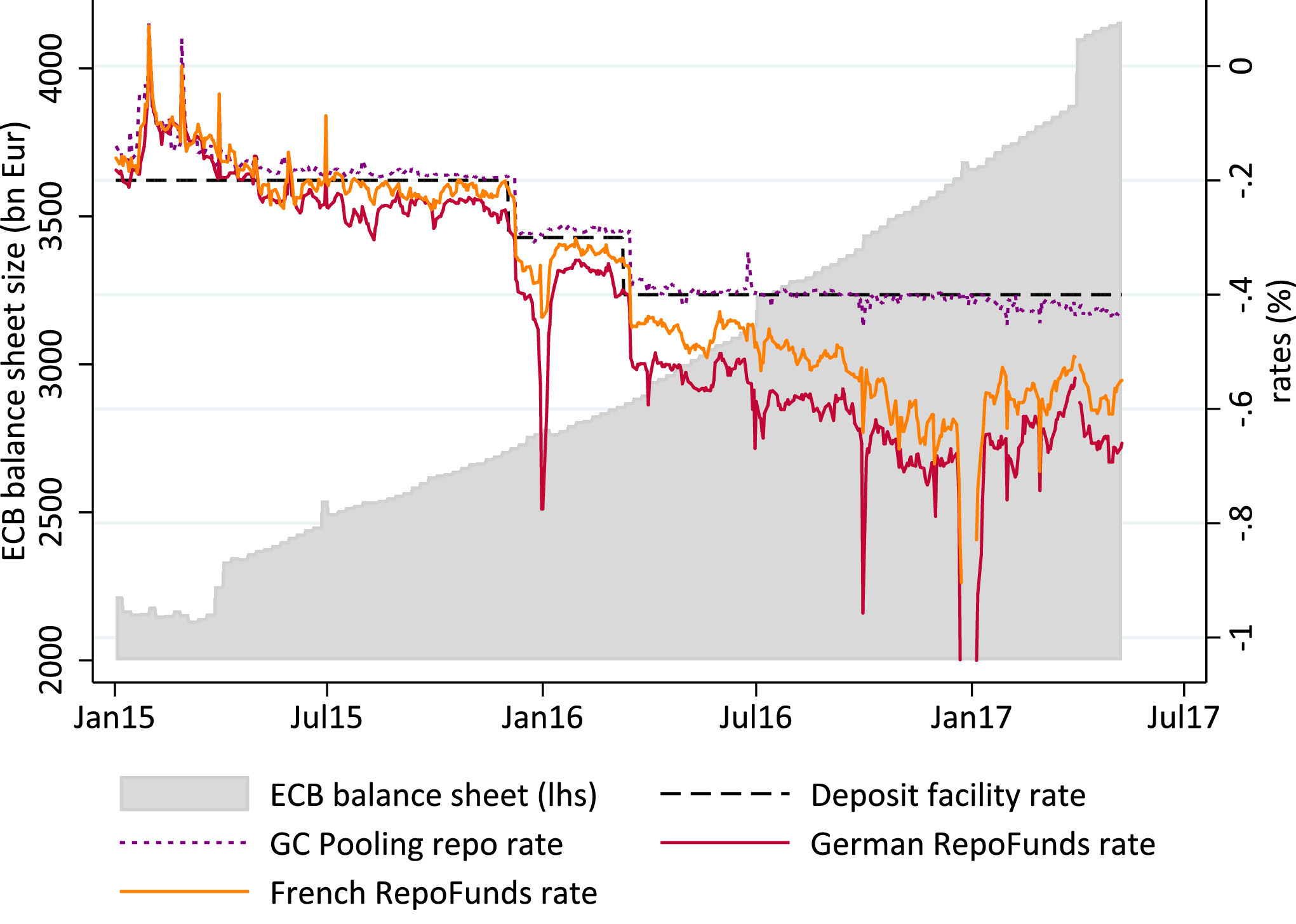

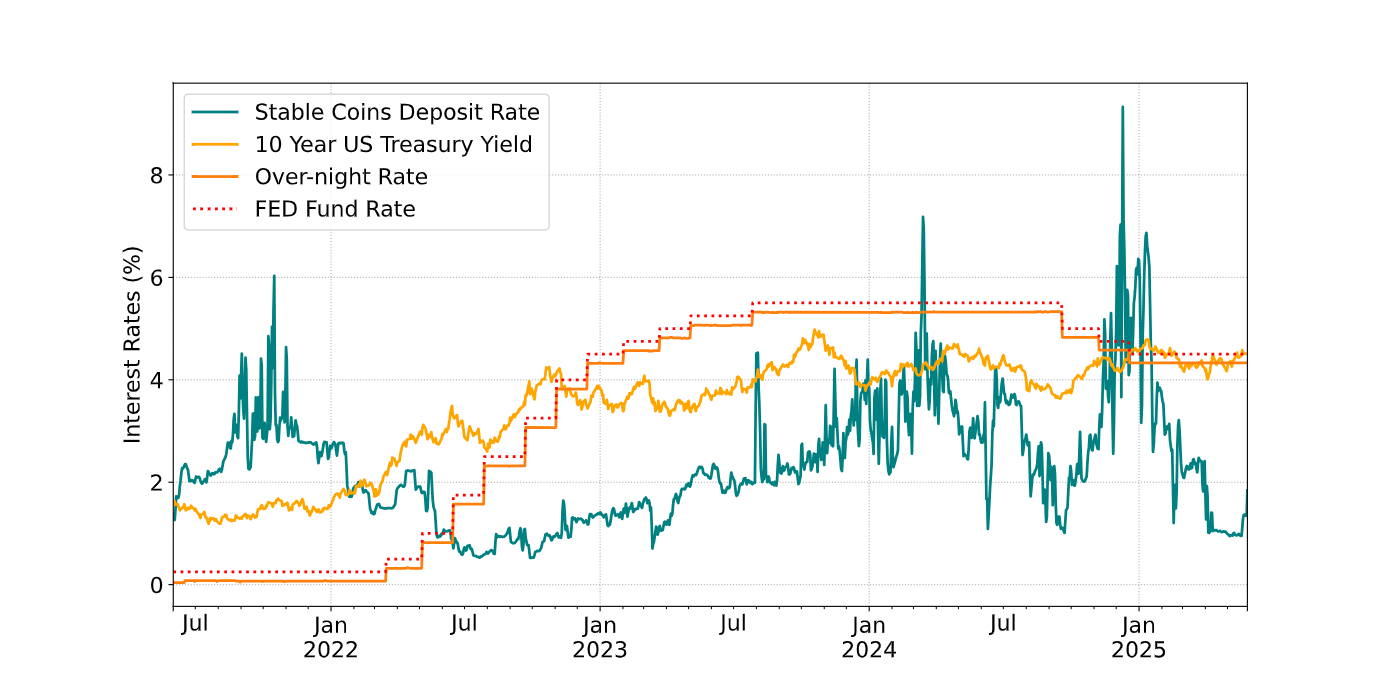

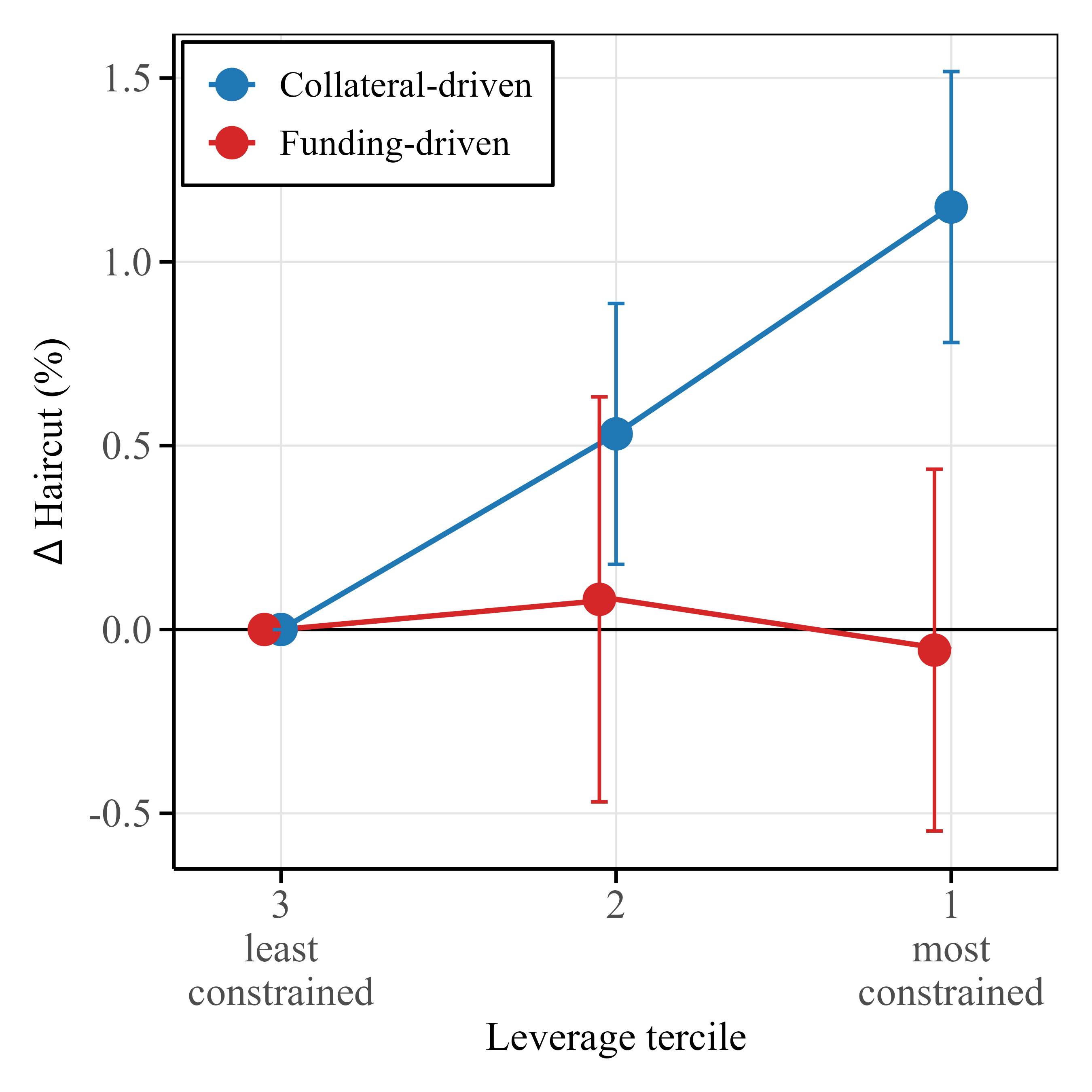

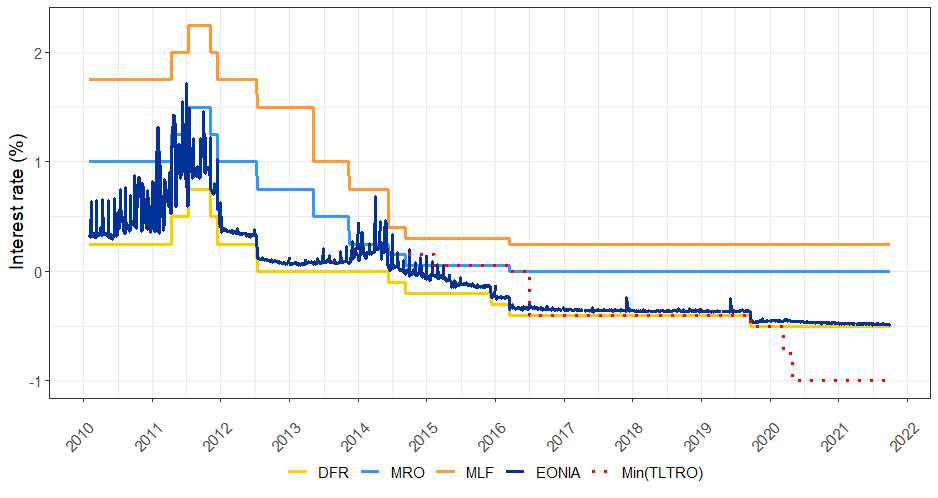

Since joining central banking in 2009, I have worked at the intersection of monetary policy implementation, financial markets’ plumbing, and academic research. I currently work at the European Central Bank, where I lead a team in DG-Market Operations, coordinating analytical work on market functioning and monetary policy implementation. I have previously held several positions at Banque de France and the ECB in DG Monetary Policy Strategy, DG Market Operations, and DG Research. I strive to produce policy-relevant research that advances academic knowledge and anticipates structural changes in financial markets. My research, published in academic journals such as the Journal of Financial Economics and Journal of Applied Econometrics, examines how central bank policies affect bond and repo markets, how portfolio allocation interacts with asset pricing, and how market plumbing and intermediaries create financial frictions. From this background, I have studied crypto markets, especially how stablecoins and tokenized assets interact with traditional finance.

News

| Dec 30, 2025 |

|

|---|